Over the last few months, Google has been honing and preparing what they call the “Dealer Playbook” – an attempt to get dealerships to reset, focus on what’s truly important, and drive traffic that can actually create incremental business.

If you haven’t already seen the New Dealer Playbook from Google, do ask your agency partners or account manager to discuss it with you.

We thought it would be a good idea to pen our thoughts from the perspective of an agency whose lifeblood is digital marketing for car dealerships.

The crux of Google’s playbook.

If there are two things worth focusing on and discussing they’re as follows –

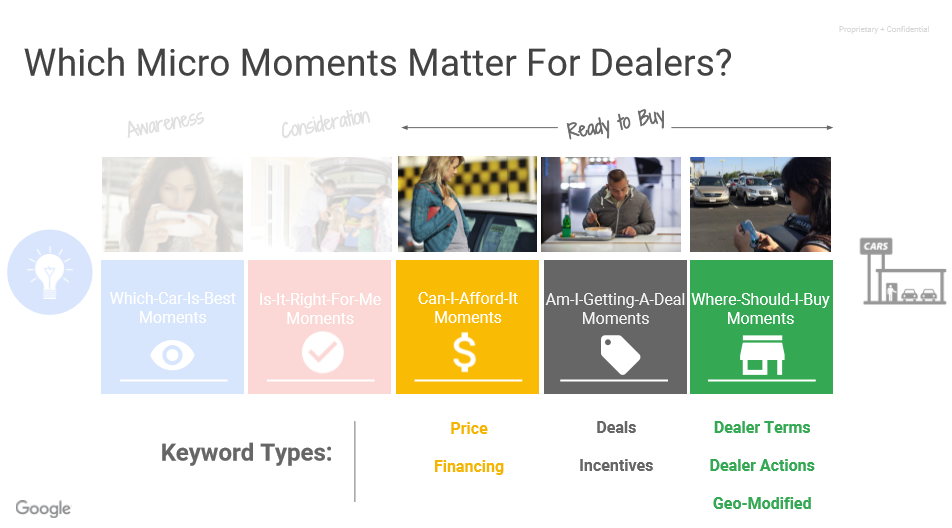

- An emphasis on Micro-Moments, which are critical in today’s hyper connected, multi-device world; and in turn pointing out which search terms and which consumers dealers should actually be focusing on.

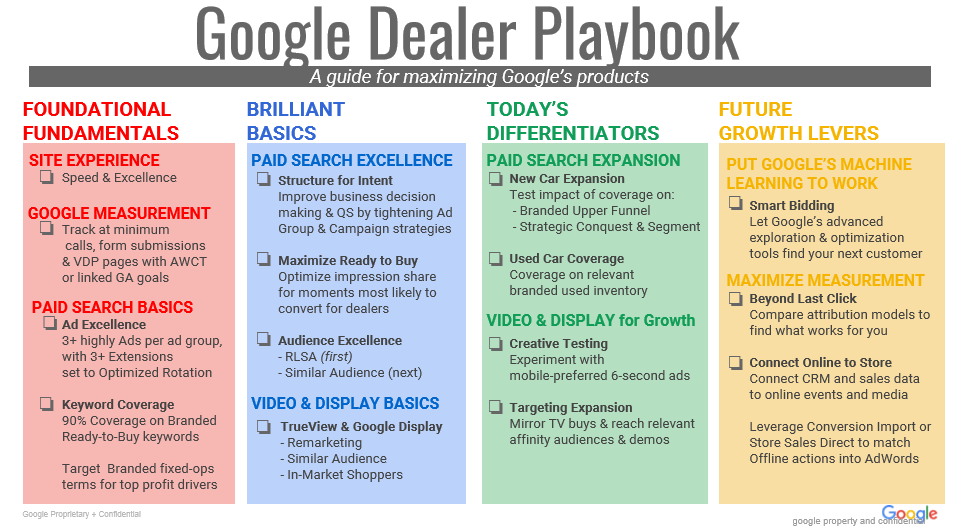

- An emphasis on ensuring that you or your advertising vendor are paying attention to the fundamentals first, and then moving on to the cutting-edge technologies after you have a solid digital marketing base. Our industry is full of shiny objects, so this is a welcome move to re-focus us (dealers and agencies) on the things that are truly going to move the needle in terms of what matters – leads and car sales. Google has captured this extremely well in the snapshot below.

Our Thought Bubble – What DealerOn thinks

Let’s talk about the “Micro-Moments” approach first. Our team has a collective 50+ years of experience in automotive digital advertising. Over the past few years, we’ve been analyzing our data closely and we’re thrilled that Google’s micro-moment approach mirrors the approach we’ve been taking. The only difference is in terminology.

What we’ve advocated from the very beginning is that dealers focus on what we called “shopping or buying intent terms” and prioritize them over “research terms” (see graphic below). Buying terms tend to have higher conversion rates, higher quality scores and lower cost-per-click and cost-per-lead. They tend to drive a lot more form submissions on the site and tend to have a higher close ratio when we track down to the sale.

An important aspect to note, is that the average dealer in the US spends anywhere between $4,000 – $7,000 on their SEM budgets. In light of this, and assuming that a dealer isn’t willing to spend any more (for any number of reasons), it is crucial that dealers emphasize and focus on getting the highest impression share possible on “buying intent terms / micro-moments” before focusing on anything else.

We’re certainly not saying that dealers shouldn’t buy terms like “2017 Toyota Camry”. Instead, we’re saying focus on buying “2017 Camry lease or 2018 Toyota Camry offers” first and as you watch your budget utilization or impression share, continue to add research terms. Of course, if you’re starting out with a $20,000/month search budget, it’s a lot easier for you to accommodate all types of campaigns.

Now let’s look at the other crucial aspect of the Google Dealer Playbook – the slide on “maximizing Google’s products.”

Google has done a great job of laying this out in a digestible format that isn’t overwhelming. We’ve tried to map this out against what DealerOn is doing for customers against each of these 4 categories.

- “Foundational Fundamentals” – If you’re not knocking these out of the park, you’re not using Google the right way.

| What Google Recommends | Our Thought Bubble (What’s DealerOn Doing?) | Any Caveats? |

| Site Experience | We’re all about faster speeds and quicker load times. We encourage dealers to test their site on www.webpagetest.org (this is also the site that’s now powering google test my site tool). | Yes. Site speed has a lot to do with what other tools, widgets, and gadgets you’ve chosen to add or integrate with your site. Keep that in mind as you evaluate your vendor. DealerOn or otherwise. |

| Google Measurement | We’ve always seen Google Analytics as a reliable and true source of data. All our accounts are linked to GA with the appropriate AdWords linking, goal creation, and other recommendations | None. |

| Paid Search Basics | DealerOn has been creating multiple ads per ad group and emphasizes 90% coverage on shopping terms. With regards to ad extensions, we encourage dealers to go beyond the standard location, call, and site link extensions by adopting call out, review, and price extensions where available. | Yes. Dealer’s should pay attention to Google’s 90% coverage requirement, however, it needs to be in the context of your budget, your location (rural v. urban), and CPC as driven by competition. |

- “Brilliant Basics” – Basic but often overlooked… powerful tactics worth prioritizing before the rest

| What Google Recommends | Our Thought Bubble (What’s DealerOn Doing?) | Any Caveats? |

| Paid Search Excellence | DealerOn’s account structure is built to mirror a moments/ buying–first approach. RLSA’s are definitely a powerful feature, which DealerOn has been testing over the last two quarters and will be close to a 100% rollout for all accounts by the end of Q3. | Yes. Pay close attention to bid modifications on RLSAs. Often times, we’ve found that dealers are creating modifiers way higher than needed. It is OK to start with a base increase of 40% – 50% but know that it isn’t necessary. |

| Video & Display Basics | DealerOn is fully capable of delivering high performing YouTube campaigns that deliver high view through rates and low Cost-Per-Views. We’re also huge fans of using YouTube and Display as powerful mediums for remarketing. | Yes. Dealers need to have the budgets to support Video and display / remarketing campaigns.

|

- “Today’s Differentiators” – Tested & true growth strategies… some dealers are all-in, while others have yet to see the light.

| What Google Recommends | Our Thought Bubble (What’s DealerOn Doing?) | Any Caveats? |

| Paid Search Expansion | As we’ve mentioned earlier in the article, DealerOn is 100% on-board with the approach of expanding to more “research-oriented” terms once a dealer has captured a high impression share on terms that have a shopping intent behind them.

|

|

| Video & Display for Growth | DealerOn’s internal data has shown that offer-specific ads are much more likely to pique a consumer’s interest than other formats. We’re also becoming fans of Google’s responsive display ad formats, which seem to have a much higher click through rate. | Be wary of where your ads are showing. Mobile formats, while great, have an innate tendency to show up on mobile apps. We’re generally skeptical of such ad placements. Your agency should monitor ad placements on a monthly basis and ruthlessly exclude low performing placements and sites. |

- “Future Growth Levers” – Where the savviest dealers are already testing, where Google & our most sophisticated marketing partners are placing bets.

| What Google Recommends | Our Thought Bubble (What’s DealerOn Doing?) | Any Caveats? |

| Put Google’s machine learning to work (aka smart bidding) | This is one area where we think we have some day-light between Google and ourselves. Like a lot of other agencies, we believe Dealers should focus on Google but not discount other important channels such as Facebook and Bing. Given that you as a dealer want to see ROI across all channels, using a call / conversion tracking platform that is consistent and can be deployed on multiple platforms is critical.

Smart bidding works extremely well when using only Google conversion tracking, which isn’t always possible.

|

Yes. Most providers of repute have either tied up with major bid management platforms or are using their own home grown tool-sets.

Be careful not to fall into the “hourly bidding trap”. Hourly bid systems are wonderful if you’re Costco.com getting thousands of clicks every hour. For dealers whose daily budget on average is $200 per day, there just isn’t adequate validity to the data to make good decisions. |

| Maximizing measurement | DealerOn already offers a track-to-sale feature for customers using both its advertising and website products. Like a lot of others in the industry, we believe this is where the future is going and are investing heavily in it. | Yes. Tracking to sale requires access to data and not all dealer groups or dealerships are willing to provide such access. DealerOn has manual workarounds to tackle this problem. |

In Summary and Conclusion

- We think the Google Playbook is a great reset for the auto industry, which is being bombarded with new products and offerings. We’ve seen time and again that the fundamentals are ignored or handled incorrectly in favor of what sounds like the coolest thing on the market place.

- We agree 100% that dealerships, especially those with budgets under $7,500/ month for Paid Search, need to emphasize shopping or buying related terms more than research oriented terminology.

- Dealers should not ignore Bing and Facebook. In fact, the approach to Bing needs to be the same – buying first, research next. Facebook offers a plethora of granular targeting options that can provide a powerful way to reach in market shoppers in your local markets.

- We’re excited to be in-sync with what Google sees as the gold standard for operating automotive digital advertising and we intend to continue being at the forefront of developing and adopting best practices.

- Lastly, as a rapidly growing Google Premier Partner we have a front row seat to Google’s offerings and we’re excited to bring them to our dealer partners.

If you’re interested in learning more about DealerOn’s Advertising offerings – hop over to Booth #305 for a chat OR feel free to shoot us a note at ppc@dealeron.com.